The King of Funny Money

These are two Bond notes issued in late 2016 ($2) and early 2017 ($5). Zimbabwe on 12.04.2009 abandoned its own currency to end hyperinflation and commenced using foreign currencies such as US Dollar, South Africa Rand, Euro, British Pound, Botswana Pula, Indian Rupee and even the Chinese Yuan and Australian Dollar as legal tender (some of these foreign currencies were added on later). These Bond notes are redeemable for all these foreign currencies or can be used as normal day to day transactions. However these Bond notes are not legal tender outside the country. The value of these Bond notes are at parity with the US$ when it was first issued.

The Zimbabwe inflation crisis started in the late 90s when President Robert Mugabe removed white farmers and replaced them with blacks farmers. Unfortunately due to lack of experience in managing these farms, the production dropped and so does foreign incomes too. To overcome this, the government decided to print more money to pay for their bills. Now, any Economist out there will tell you that this will not work unless you have the foreign reverse to back this up. Whilst this is bad to the country, it was a haven to collectors, including myself. Since 2006, a total of 70 notes were issued from 1 cent to 100 Trillion dollars. I still do not understand why they even bother to print those lower denomination notes such as the 1, 5, 10, 50 cents and even the $1 when the values do not even worth the paper printed on.

The issue of these Bond notes was authorised by the President Robert Mugabe on 07.11.2016 to tackle the shortage of cash in the country. The country spent more than it raised, much of it on imports causing the outflow of US$ out of the country. These new Bond notes were backed by US$200 million held in actual reserve when they were issued. To the locals, the nickname for the Bond note is called "Bollars". Interesting to note that Zimbabwe was once called the food basket of Southern Africa.

Since the release of the Bond notes at the end of last year, the dollars are losing its value. The local businesses are so worrying that as these new Bond notes have no value outside the country, it may lead to the drop in value. Some shops which are desperate for hard currency, are offering discounts on their goods, some up to 50% if payments are made by US$. Old habits die hard!

Signature: Governor Dr John Mangudya

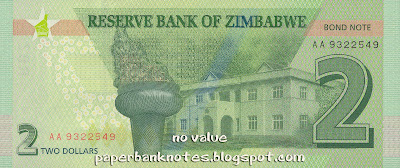

Two Dollars (Bond Note)

|

| Dated 2016, P99, issued in November 2016 |

|

| Reverse |

|

| Dated 2016 (2017), P100 |

|

| Reverse |

$5 - 3,000,000 pieces ($15,000,000) Issued on 02.02.2017.

Added on 15.04.2020

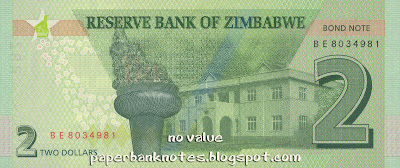

I have added these two $2 and $5 Bond Notes, first issued on 28.11.2016. I believe these are printed by a difference imprinter from those first issued in 2016. Apart from this I do not have any other info available to confirm this. The most visible differences are the fonts on the serial number. If you look closely and compare with serial numbers of 0, 6 and 9, you will see that the fonts are not the same. In view of this, this deserved to be mentioned and catagorised as another variety. The notes have since been replaced by the two notes of $2 and $5 both issued in late 2019.

Two Dollar Bond Note

|

| Dated 2016, second print |

|

| Reverse |

|

| Dated 2016 |

|

| Reverse |

No comments:

Post a Comment